Cryptocurrencies

Cryptocurrencies

This follows up from Cryptocurrencies don't make sense.

https://ftalphaville.ft.com/2018/05/30/1527652800000/Crypto-s-most-devout-believers-are-suffering-a-crisis-of-faith-/

Background

Cryptocurrencies either aim to be a direct replacement for fiat money (like Bitcoin/Litecoin/Monero), or to provide some economic function where then the cryptocurrency underpins the integrity of this function, (like Ethereum/Ripple).

For a good description of the technological fundamentals of cryptocurrencies on YouTube see this, while the most entertaining take is by John Oliver.

While the terminology is in some flux with the term "cryptocurrency" usually synonymous with "virtual currency", while "cryptoasset" is used for a subset of these, I will use the term cryptocurrency to refer to all of them.

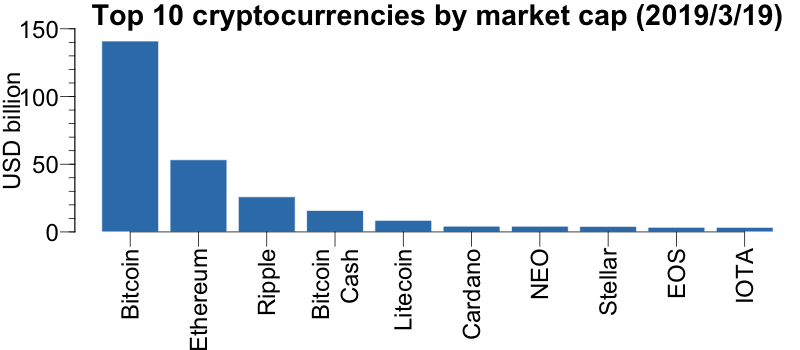

The original cryptocurrency, Bitcoin, was envisioned as a replacement for fiat cash. It retains the first mover advantage, with the highest market cap of about $150 billion at the time of writing, see coinmarketcap.com.

Bitcoin suffers from perceived design limitations, with efficiency (high transaction cost and slow speed) seen as problematic. Recent competitors, such as Bitcoin cash and Litecoin, improve efficiency.

Transactions with Bitcoin are not fully private because the underlying blockchain is searchable, and other cryptocurrencies use different technologies to ensure privacy, like Monero's ring signatures.

The visible blockchain with slow updates is what guarantees Bitcoin's trust. Improving efficiency by speeding transactions or removing visibility reduces trust.

With cryptocurrencies, there is a direct trust vs. efficiency vs. privacy tradeoff.

The main competitor to Bitcoin is Ethereum, aiming to be a globally distributed computer program — world computer — designed to execute [smart contracts](https://en.wikipedia.org/w noiki/Smart_contract).

Ripple is number three, aiming to be a new type of a fast payment system. In order to achieve that, it gives up on blockchain and its native technological trust, replacing some of it it with trusted institutions — typically banks.

The following figure shows the market cap of the top 10 cryptocurrencies on March 19, 2019 from coinmarketcap.com.

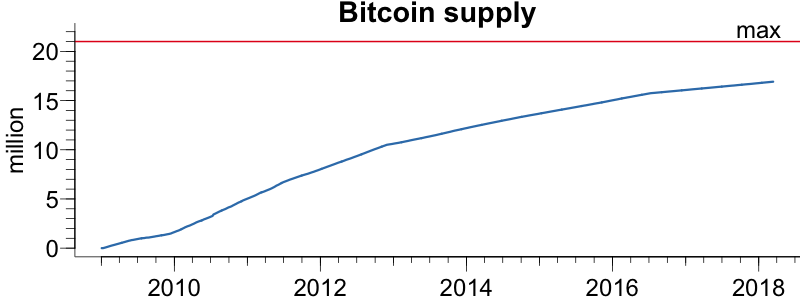

The total volume of cryptocurrencies is typically controlled by an algorithm set up so that some computationally intensive operation is required to create new units of the currency — mining — where the computational problem becomes progressively harder until some other hard limited is reached, what is known as controlled supply. In the case of Bitcoin, the theoretical upper limit is almost 21 million, expected to be reached around 2140, and we now have almost 17 million Bitcoins or 81% of the total. The following figure shows the supply until now.

Most other cryptocurrencies follow a similar set up, but often with a faster mining schedule. With some there is pre-mining, which may create trust issues.

It is the controlled supply that provides the main argument for cryptocurrencies actually being money. This argument deliberately mimics gold as money discussions: A cryptocurrency based monetary system is to be a modern version of the gold standard.

The cryptocurrency debate

Cryptocurrencies are increasingly controversial. While initially passing without much notice, recently they have made mainstream news and the various financial authorities have expressed increasing concern.

The main arguments in favour of cryptocurrencies are typically some combination of:

- technology;

- money;

- freedom;

- trust;

- privacy/anonymity;

- efficiency;

- the unbanked and those living in countries with crap currencies;

- there is money to be made;

- even the central banks are in on the action.

1. Technology

The technologies underpinning the various cryptocurrencies are quite elegant, and many of those who argue against them are often called Luddites, or said to otherwise not understand technology.

I have lost count of the number of people who have told me that the Internet was misunderstood in the early 1990s and see how big it became.

However, an elegant technology does not imply real world usefulness. Knowing all their mechanical details does not translate to understanding their economic or social function.

Take as an example human beings. I can know all the physics and chemistry and physiology, understand how molecules and organs operate, yet still not know the first thing about an individual.

Therefore, what the advocates of cryptocurrencies should show is how they solve real-world social problems, and not just resort to arguing that the underlying technologies are elegant, or just mysticism to justify them. Yes, there are several use cases for cryptocurrencies, but nothing sufficiently substantial to justify their evaluations or supposed impact on the economy.

Someone might retort that cryptocurrencies might be inefficient and insecure today and without large applications, but that will improve in the future.

A marvellous technological solution where the real benefits are promised and not real is just a pie in the sky promise. Otherwise the flying cars and all the fantastic last century technology promises would be with us today.

2. Money

What do we need money for? The Wikipedia page on money, lists:

- medium of exchange;

- measure of value;

- standard of deferred payment;

- store of value.

My list is slightly different, encompassing the Wikipedia list and adding lending of last resort and the economic considerations:

- facilitating transactions;

- storing value;

- lending of last resort;

- controlling money supply to suit the economy.

We have been debating what money is for long time. The lists above are what most mainstream economists would subscribe to. But there are strong opinions to the contrary.

There are two related arguments made.

- the supply of money should be tied to some real good, typically gold or Bitcoin;

- money should not be a government monopoly but created by the free market.

Over time, we have used a number of assets as money, silver, copper, seashells and cigarettes. However, the asset best associated with money is gold, and the longest period of monetary stability the world has ever seen, the gold standard of 1873 to 1914, was based on money being gold.

Of course, it isn't quite that simple as money and monetary stability in Europe, 1300-1914 show. There is plenty of room for manipulation.

So, does it make sense to use a real asset, like gold, or a cryptocurrency as money instead of fiat money?

If we want to link money to some real assets, gold is probably the best choice, and many cryptocurrencies advocates propose Bitcoin or something similar in its place, primarily because it supply is fixed.

But there are however several reasons why fiat money is better than either gold or cryptocurrencies.

To begin with, transactions with fiat money money are much cheaper and faster than any of the cryptocurrencies. Transactions with cash are costless and instantaneous, and so are many electronic transactions. The latter of course depend on the country, it is much more efficient in places like China and Scandinavia than for example in the United States or Germany. However, that is not a failure of fiat money, its a failure of the financial technology used in these countries.

Blockchain based cryptocurrencies like Bitcoin are inherently slow if we want to trust the transaction, at least 10 minutes or even an hour. And it is not costless. Over the past six months, the transaction costs for Bitcoin have ranged from $1.30 to $55. If we want to speed this up, or make it cheaper by going to a different cryptocurrencies, trust has to give.

Meanwhile, I can transfer any amount out of my bank account to someone else instantaneously at no cost, via my mobile phone, at least here in the UK.

What is missing is a better way to send money between countries, and cryptocurrencies often have the advantage. Within Europe, SEPA is already quite efficient, but outside of that one may have to use SWIFT, which is slow and expensive, and was recently hacked. However, several fintech initiatives based on fiat money aim to solve this, for example TransferWise. Solutions in the international transfer space are developing rapidly, eroding the cryptocurrency advantage.

Fiat money is much more efficient as a store of value, at least in those countries that follow sound principles of monetary policy.

And that leaves the strongest argument against cryptocurrencies as a good form of money, which is the same argument one makes against basing money on real assets like gold.

The concept of money is not simple, it has multiple forms, M0 is cash, M1 is instantly available money like cash and checking accounts and M3 is a broader definition take into forms of money that is similar but broader and less liquid than M1.

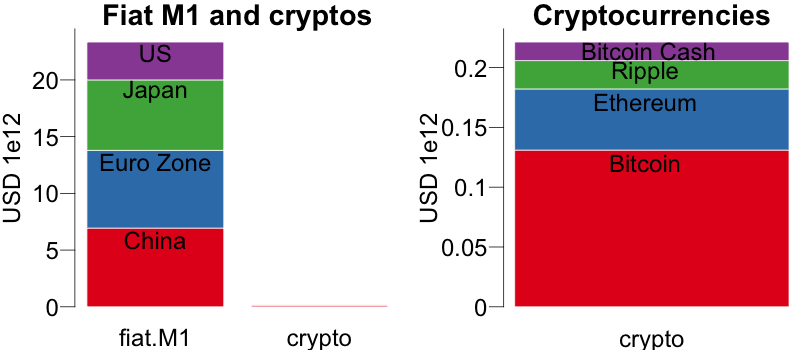

If we compare the economies with the largest money supply to the four largest cryptocurrencies, (see the following picture)

the volume of M1 fiat money is over 100 times that of cryptocurrencies. If cryptocurrencies are to replace fiat money, they need to increase significantly in value. That will of course be highly valuable to existing holders of cryptocurrencies, but at the expense of the rest of society.

Therefore, even if one buys the argument that cryptocurrencies will replace fiat money, we need something more fair than existing cryptocurrencies.

If we want money to make the economy work more efficiently, the supply of money needs to adjusted to best facilitate economic growth. Things like gold or Bitcoin just don't do that. Well managed fiat money does.

The central banks are able to control M0, but the broader definition of money, the less control they have. Furthermore, when we are hit by a financial crisis, people convert higher forms of money into lower forms. For example, we might not trust banks so we cash in our savings and stuff the money under the mattress.

That leads to a reduction in the supply of money, because of how the higher forms of money are created. Suppose I put $1000 of cash into my checking account, the bank lends $900 out of that to someone else keeps it in their checking account, the total amount of M1 is $1900 while M0 remains $1000. If that loan is used to back real economic activity, like a loan to a small or medium-size enterprise, this deleveraging will reduce economic activity.

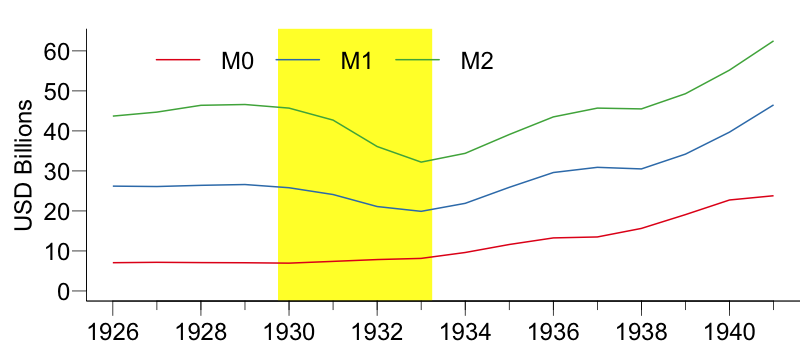

The following figure shows the supply of money in the United States in the Great Depression 1929 to 1933:

We see a rapid reduction of supply of M2, while M1 moderately increases, signalling that people are deleveraging on a rapid scale, which in turn slowed down the economy and was the main cause of the Great Depression.

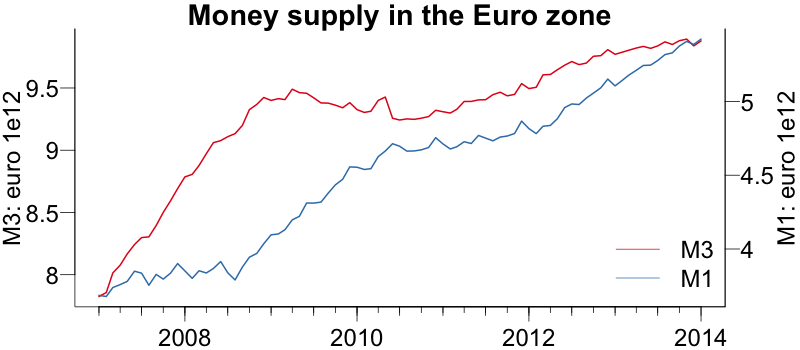

We have as we have seen the same on a smaller scale since 2008. The following figure shows M1 and M3 in the euro zone. At the height of the European crisis, M1 was growing rapidly while M3 was contracting.

This is perhaps the biggest advantage of central bank issued fiat currency (at least where the central banks are credible) over any of the crypto occurrences. The supply of fiat money can be adjusted to best serve the economy

Suppose then we don't think fiat money does this well. It didn't in the 1970s, giving us stagflation.

In a free market, the best money would win out, as eloquently expressed by Hayek's 1977, "Free-Market Monetary System". A good modern analysis of that is by Jesús Fernández-Villaverde and Daniel Sanches "Can currency competition work?".

However, monetary policy has improved since then, and we now know that a credible central bank, with sufficient political cover, using inflation targeting, is the best way to achieve price stability and stable growth without too many deep recessions.

3. Freedom

Cryptocurrencies do promise freedom, as this article Welcome to Liberland: the nation that Bitcoin built stresses. This relates to the ideas on self sovereign identity.

Fiat money is controlled by the government, and governments are anything but shy in using their powers over money to control their citizens and other countries.

Therefore, for those who resent such government control, forms of money that are outside of the control of government and whose quantity and integrity are guaranteed by a technical solution, are attractive.

This is a long-running debate that predates cryptocurrencies. For example, in the United States in the 19th century (witness the debate over the establishment of the Fed in 1913), and the free market monetary discussions in the 1970s.

And for those for which this matters, cryptocurrencies can make sense. This however is a tiny fraction of society.

And even then, I question the freedom one gets, because even with cryptocurrencies, the governments can and will exercise control, as discussed below.

The idea that cryptocurrencies will provide freedom is just a dream. On planet Earth, it will not happen.

4. Trust

One of the most hyped feature of cryptocurrencies is trust. Instead of untrustworthy institutions, our money and transactions with it are are protected by an algorithm we can trust.

The use of electronic fiat money requires money to go through several systems, often starting with a payment processor, then a bank on both ends and a payment system in the middle.

We have to trust that all these entities have our best interests at heart and are keeping our money safe. We also have to trust the government not to confiscate or devalue our money.

Cryptocurrencies promise to replace that with algorithms, see e.g. Bitcoin security model: trust by computation. We trust the network because the interaction between market participants is protected by algorithms that are practically impossible to manipulate. If we want to hold an an asset that does not require us to trust any trust third party, an asset that that can not be censored or confiscated, cryptocurrencies might seem attractive.

So long as we trust the algorithm, we are safe.

Besides that, the algorithm is only the theoretic middle part of the transaction. There are a lot of practical implementation details that erode the trust.

Some tiny segment of the population is sufficiently technically adept so that they can implement the entire thing themselves, and trust their own work. The rest of us have to rely on someone else for implementation.

And then we are left with trusting unknown entities. Here is a small list of what can go wrong.

- Front running. If we are trading cryptocurrencies there is nothing preventing the exchange from front running. It is not illegal and it is not verifiable;

- Cornering illegal in most markets, is common and legal in cryptocurrency trading;

- Pump and dump is illegal, except with cryptocurrencies. One can even hire companies that will do pump and dump;

- Hacking. The best practice in trading cryptocurrencies is to keep one's keys on an air gapped laptop. We are constantly hearing about people who have their money stolen and that the various ways one transacts in cryptocurrencies are subject to hacking;

- The intermediaries are by and large unknown and shadowy. How do we know that the way they implement trading is not to their benefit and not ours?

- If something goes wrong, one has no recourse. There are no regulations, legal system or police that protect. This is by design, because the cryptocurrencies are meant to operate outside the state. But that means less protection.

Electronic fiat money and traditional assets are of course subject to all of these to some extent, but on a much smaller scale than cryptocurrencies, not the least because we are protected by securities law, financial regulations and the legal system.

If we take elementary precautions, internet banking and electronic fiat money transactions are quite safe, and we are protected by multiple layers of security. The chance of hacking is very low and in the event, we have recourse.

I am perfectly happy to do online banking without constantly looking over my shoulders or resorting to air gapped laptops.

The concept of trust does not only apply to the algorithm, it applies to the entire transaction. And I trust my bank and my payment system much better than any cryptocurrency intermediary.

So, from the point of view of trust, fiat money is much superior to cryptocurrencies.

5. Privacy/anonymity

Some cryptocurrencies, like Monero, promise privacy. That we can enter into a transaction without anybody knowing about it except we and the person we are dealing with.

The most popular cryptocurrency, Bitcoin does not, unless one is really careful in hiding one's tracks, using skills that are only available to a small group of users. The reason is that transaction records on the blockchain cannot be changed or deleted and are therefore searchable.

However, trust is provided by the blockchain being visible. If we want purely anonymous transactions, trust has to give. The question is to what extent.

There is no such thing as 100% privacy. Fiat cash is fully anonymous, but someone might be monitoring the transaction. If we move to electronic fiat money, we are subject to tracking, both by private companies and government authorities.

Same with even the most privacy focused cryptocurrency, the starting point is the internet, giving scope to monitoring.

Yes, it is conceivable that two entities are able to conduct business by only using a privacy based cryptocurrency, with correctly implemented end-to-end encryption and no monitoring of the exchange of goods. Even then, the transaction would have to be based on some goods that are outside of the standard economy — like drugs. An advocate of cryptocurrencies might say that in the future we will be able to buy real goods with them, but that is not true, as discussed below.

And meanwhile, while Bitcoin is the most liquid cryptocurrency, it is not exactly what one would call liquid in the sense that fiat money is. Moving to some untested and highly illiquid cryptocurrency that promises privacy and trust, needs a considerable leap in faith and belief.

However, this one area where a central bank issued cryptocurrency might have an advantage, even if, I don't think they would want to.

6. Efficiency

Some cryptocurrencies, most prominently the second largest Ethereum, are not really designed to be replacements for money, but provide other services.

Ethereum emphasises smart contacts, something that sounds really clever until one extra tries to put in practice, when it becomes distinctively pedestrian.

The starting point is some distributed ledger technology, like blockchain, for holding assets. Then, smart contracts replace the need of having to employ lawyers and even third-party escrow.

This can be beneficial, and is likely to be increasingly implemented, but it can certainly be done without a cryptocurrencies attached. A crypto advocate might say that trust is provided by the cryptocurrency, but there is nothing conceptually preventing us from using trusted institutions.

If we don't like to trust institutions, we are back to freedom, as discussed above.

7. The unbanked and those living in countries with crap currencies

Many advocates of cryptocurrencies argue that while there may be little reason to move to cryptocurrencies for those living in developed countries with relatively credible central banks and governments, that does not apply to all. Some countries have unstable governments and/or have large segments of the population unbanked. Cryptocurrencies then solve that problem. Often cited examples include places like Zimbabwe and Venezuela. The latter has even created its own cryptocurrency.

In countries with high inflation, people usually seek out other currencies, typically the US dollar. Transactions might be made entirely in dollars or prices may be quoted in dollars while transactions take place in the local currency at the spot rate.

This is called dollarization or currency substitution.

I can't see how citizens of countries with unstable monetary policy are better served by cryptocurrencies than the most widely available fiat currency, the USD, or possibly the Euro.

The problem of the unbanked can be solved by fintech, banking via mobile phones, and the like. However, such a solution is currency agnostic. It is a technological solution and one can plug in any currency. The unbanked would be much better served by a stable fiat currency that is accepted everywhere coupled with innovative fintech solutions.

8. There is money to be made

Any asset can get into a bubble. People will buy it because they expect others to pay a higher price in the future, creating a positive feedback.

A Bitcoin was worth $0.06 in 2010, and $9800 on last count. So a 16 million percent return.

Someone who invests early and gets out in time, will make money, just like an early investor in a Ponzi scheme will make money provided she gets out early.

So this leaves two questions:

- what sort of investments are cryptocurrencies;

- does it make sense to invest in them?

Investments like stocks and bonds have value because we have expectation of future income.

Other assets have value because we expect people to pay for them in the future.

Collectibles are of the latter category. The Wall Street Journal ran an interesting story recently Sorry, Collectors, Nobody Wants Your Beanie Babies Anymore "Over two decades after the great Beanie Baby craze, speculators are back, hoping someone will finally buy their floppy collectibles." It is the same with collecting art and stamps. Collectable stamps have scarcity value, some cost more than $200k, just make sure to buy at the right time.

Fiat money also falls into this category. It only holds value if the central bank and the government manage it properly, and in cases where they do not, the use of fiat money can be very costly, and in extremis result in hyperinflation.

Cryptocurrencies are more like stamps, fiat money and Beanie Babies, not stocks or bonds. Their price is derived from what people will want to pay in the future, not from a revenue stream like stocks and bonds.

That does not mean there is not money to be made. However, one is well advised to keep the lessons from global games in mind. You can see the model in my slides on this in a currency framework here, from page 57.

It is especially important not to be affected by hindsight bias. Just because the price of something increased in the past, does not mean that it will increase in the future.

Those who have made money out of cryptocurrencies have done so out of luck, not because of anything fundamental.

A counterargument might be that the supply of cryptocurrencies is limited by costly mining and may have a fixed asymptote — just like gold. As to the former, sunk cost should not affect the value of assets, but the limit to supply is more relevant.

However, that is only an advantage if the alternative is unstable fiat currency, and does not apply to countries with credible and well-managed central banks.

Perhaps the hope is that is cryptocurrencies manage to displace fiat money, the market cap of the cryptocurrencies will equal that of fiat money. Then, as the graph above shows, considerable profits await. However many things are in the way before that can happen. It is not fair and the governments will not allow it.

9. Even the central banks are in on the action

Most central banks are actively studying cryptocurrencies and have even considered issuing their own. See for example the Bank of England and the more academic BIS paper "Central bank cryptocurrencies" by Morten Bech and Rodney Garratt.

So why should a central bank do that? Besides just keeping up with popular technology, many central banks would like to get rid of cash, like the Bank of England (or at least its chief economist). While they might think they have a good reason to do so, it is a terrible idea.

But why should a central bank issue cryptocurrencies? Bech and Garratt argue that retail clients might benefit from anonymity and the ability to hold accounts directly with the central bank, while wholesale clients might benefit from increased efficiencies. Furthermore, a central bank issued cryptocurrency might have the advantage of a fixed supply and one-to-one convertibility to other forms of money. Such money might solve the problem of the zero lower bound. Furthermore, a central bank cryptocurrency would likely have the price stability that other cryptocurrencies lack. Perhaps the main benefit is international money transfers.

All of these make sense, but seem to be rather minor advantages, except the zero lower bound and anonymity (and I suspect the central banks could not countenance that very same anonymity,) and the broader discussion of control of money supply. Under the current system, the central banks do not fully control the money supply, except M0. This is why we had all the experimental monetary policies, low interest rates and QE over the past 10 years.

So, if the central bank issues cryptocurrencies, the supply of money, in all its forms, all the way from M0 to M3, can be controlled — in theory.

That might be a good idea because, conceptually, it gives more fine-grained control of inflation, can insulate failing intermediaries in a crisis, and perhaps most importantly, provide control of higher forms of money in a crisis when everybody is rushing to convert M3 to M0.

Except, it is more complicated, as trust gets in the way of the efficiency.

This is because of what happens in a crisis, as discussed above. Suppose the economy is deleveraging rapidly. Theoretically, with a central bank created cryptocurrencies, that process can be prevented. However, if the central bank tried to do so, its trust would evaporate.

That means, trying to control deleveraging in times of crisis could well end up amplifying the same crisis.

The power of the government

Advocates like to emphasise that cryptocurrencies exist outside of existing economic and financial structures, away from the long hand of the law. A libertarian paradise. Then, under that narrative, it is only a question of when, not if we will be able to go about our daily economic life by paying an cryptocurrencies. Like buying stuff on Amazon.

I think such views underestimate both the power of the government and its strong desire for this not to happen. The governments have the power to ensure money controlled by them remains legal tender and they will certainly do so.

What might be the objections of the government to cryptocurrencies?

To begin with is seigniorage, the profits the government gets from printing money. In the graph earlier, we saw that the value of cryptocurrencies is only a small fraction of the total value of money. If cryptocurrencies are to become real competitors to fiat money then someone will profit. And the government will want to be that someone. It would be unfair otherwise.

Second, as discussed above, it is important to adjust the supply of money to suit the economy, both routinely and with lending of last resort. In order to do that, not only does the supply of money have to be variable, it also has to be under the control of the government.

Third, with all the profits made with cryptocurrencies, the government will want people to pay taxes on the profits as this WSJ piece discusses. The US government forced Coinbase, a digital-currency wallet and platform, to turn over records on its 20 million customers. "The data include the customer’s name, taxpayer identification number, birth date and address, plus account statements and the names of counterparties." I suspect other governments are not far behind. Will people be able to hide by keeping their money outside of the US? No, as discussed below.

Fourth, microprudential regulations are designed to protect consumers, and the regulators will want to extend that to the cryptocurrency space. For example, the US SEC has taken increasing interest, as have its counterparts in other countries.

Finally, the government wants to monitor transactions and prevent terrorists and criminals from receiving funds.

As one sometimes hears from cryptocurrencies advocates, none of this matters because cryptocurrencies live in cyberspace, outside of any government jurisdiction.

Nonsense.

To begin with, any transaction involving fiat money is monitored and controlled by the government. If it is US dollars, transactions go through the US payment system in the New York Fed. Any entity that refuses to cooperate, can be denied access to the payment system. That means it is unable to transfer fiat money to or from cryptocurrencies, and any entity that does business with them will be likewise denied.

Of course, so long as money stays only within the cryptocurrency universe, that might not be all that relevant. However, the point of having money is to spend it. Most of our money is spent within a small radius of our house: real estate, schools, hospitals, grocery stores, hairdressers, etc. All of these are directly monitored and controlled by government regulators. They can and are required to report any transaction, and can easily be prohibited from accepting payment in cryptocurrencies. Perhaps, as someone told me recently, Amazon will start to accept Bitcoin. Still, Amazon can easily be required to only accept national fiat money.

So...

It is important to recognise the distinction between fintech generally and cryptocurrencies. Many of the good use cases of cryptocurrencies really are just fintech where one can plug in any type of money. This relates for example to the question of the unbanked and blockchain.

For all its faults, I cannot see how fiat money issued by a credible central bank in the 21st century is worse than any of the cryptocurrencies. There simply is no evidence to the contrary. Saying that fiat money is bad and therefore alternatives such as cryptocurrencies must be better does not make any sense unless one can show how. And that should be done in the context of the real world and how people actually use money, instead of some abstract theories of how we should think about money.

Many of the cryptocurrencies advocates who reference freedom or trust or theories of money might be well advised to keep the following in mind:

“Practical men who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back”

— John Maynard Keynes

We are not discussing cryptocurrencies in a vacuum. There is entranced incumbent technology that works really well. Show how you plan to beat fiat money, preferably without resorting to mysticism.

It is not surprising that so much of the cryptocurrencies discussion verges into mysticism. Conventional fiat money also has mystical elements, as elegantly shown by John Moore's Claredon Lecture "Evil is the Root of All Money":

"money and religion have much in common. They both concern beliefs about eternity. The British put their faith in an infinite sequence: this pound note is a promise to pay the bearer on demand another pound note. Americans are more religious: on this dollar bill it says "In God We Trust". In case God defaults, it is countersigned by Larry Summers."

I still think that cryptocurrencies are more like a religion or a cult, not a rational economic phenomena.

I still await my enlightenment.