Yesterday's mini crash in a historical context

Risk

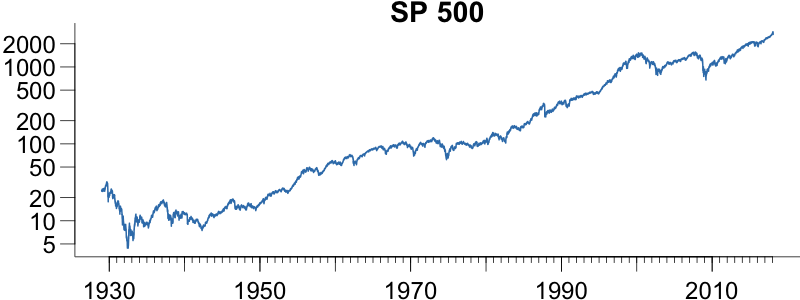

If I take the entire history of daily S&P 500 returns, which I have from 1929, and plot it on a log scale, you can't really see what happened yesterday.

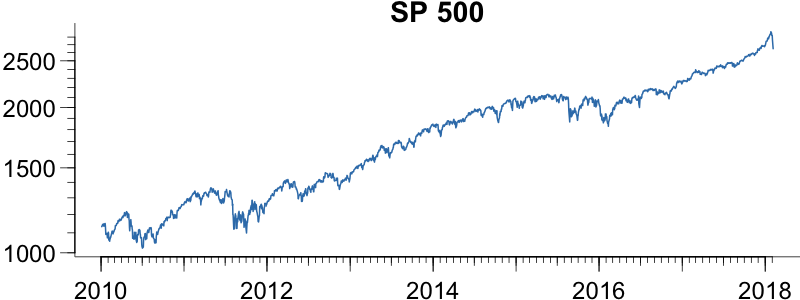

By zooming into this decade, it becomes more clear, and it does not seem to be all that significant.

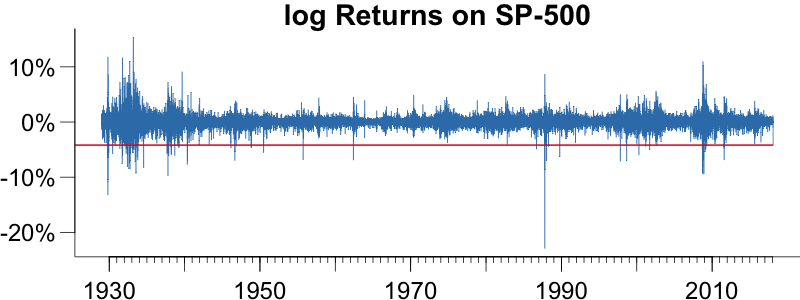

However, still hard to see. So why not look at returns (actually log returns), and for good measure draw a red line through the returns at the magnitude of yesterday's crash. Plenty of worse crashes it seems.

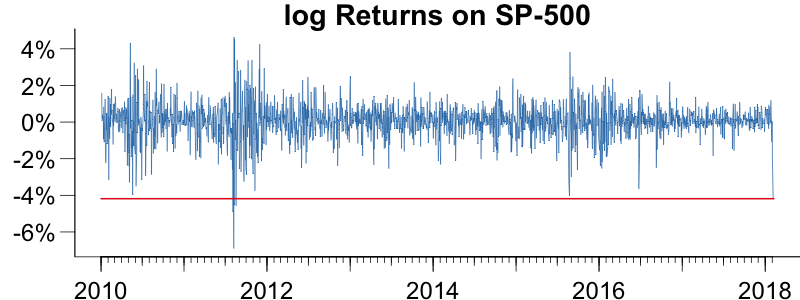

By zooming into this decade, can see that we haven't seen one like it for a few years.

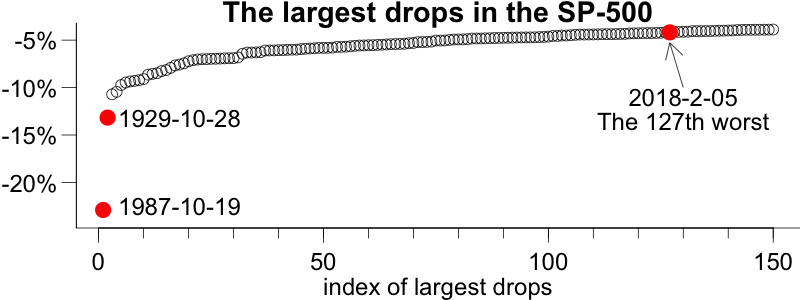

So how big was the crash in a historical context? Let's look at the biggest drops in my history, and plot them sorted, identifying the two biggest as well as yesterday:

So it was the 127th worst drop. The history is 88 years, so the magnitude of yesterday was a once in an eight month event.